Domena A. Agyeman, UCCE Economic Advisor; Butte, Glenn, and Tehama Counties

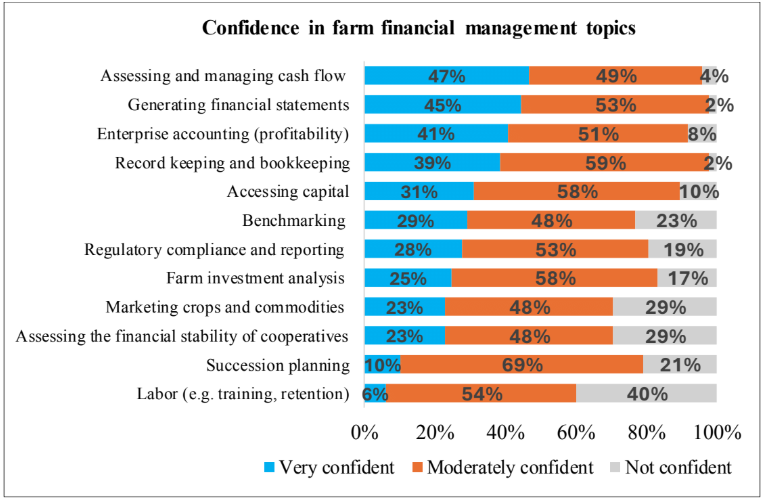

Managing farm finances can be challenging—especially for small growers who cannot afford to hire experts. However, understanding key financial statements and metrics is crucial for making informed decisions and ensuring long-term business sustainability. Many growers who completed my economics needs survey reported familiarity with various financial management topics. However, fewer than half expressed strong confidence in areas such as creating financial statements, cash flow management, recordkeeping, farm investment analysis, and benchmarking, among others—highlighting key gaps in confidence and the need for more educational resources (See figure below from the economics needs report).

To help small farm businesses strengthen their financial management skills, the Butte County Farm Bureau (BCFB) hosted an Agricultural Finance Workshop on February 20, 2025, at its Chico office. Moderated by BCFB’s Executive Director, Colleen Cecil, the event featured a panel discussion on grant writing and loan servicing, with experts from 3CORE, Morrison, Tri Counties Bank, Small Business Administration, and California Farmlink. Additionally, business financial expert Tim Peters from Morrison provided valuable insights into essential financial statement reports and metrics that every farm business should know.

Tim emphasized the importance of understanding balance sheets, income statements, and their components. The balance sheet provides a snapshot of a business’s financial position at a specific point in time, while the income statement helps assess its performance over a period. He highlighted key financial metrics and ratios that offer insights beyond what financial statements alone can reveal. Below are some of the metrics discussed:

- EBITDA (earnings before interest, taxes, depreciation, and amortization) margin (gross margin / revenue): a profitability ratio that measures a company’s operating profit as a percentage of its total revenue, before accounting for interest, taxes, depreciation, and amortization. It shows how efficiently a company generates earnings from its operations.

- Debt-to-equity ratio (total liabilities / total equity): a leverage metric that measures the proportion of a company’s debt compared to its equity. It indicates the level of financial risk by showing how much of the company’s financing comes from creditors versus owners.

- Current ratio (current assets / current liabilities): a liquidity metric that assesses a company’s ability to pay its short-term liabilities with its short-term assets. A ratio above 1 suggests good short-term financial health.

These metrics help assess a farm business’s financial health by evaluating its profitability, reliance on debt, and overall solvency. It is important for growers to become familiar with these metrics and strive to achieve their desired levels because lenders and potential investors consider them in financing decisions. Examples of preferred financial benchmarks include:

- Debt-to-equity ratio: between 0.5 and 1.5

- EBITDA margin: over 10%

- Current ratio: at least 1.25

Understanding and maintaining strong financial metrics can improve a grower’s access to credit and investment opportunities. See this handout for more details on the financial statements, key metrics, and their desired levels discussed at the workshop.

The panel discussion reinforced the importance of financial literacy for farmers. Mark Edwards (Senior Vice President for Commercial Lending at Tri Counties Bank in Chico) and Dan Zuno (Relationship Manager at 3CORE) both emphasized that small farm businesses are always welcome to seek guidance and that their institutions are committed to working with them to find tailored financial solutions. They also highlighted the benefits of farmers coming prepared with some basic financial records, as this can streamline the lending process and improve access to financing.

For small businesses located in Butte, Tehama, and Glenn counties, 3CORE offers a no-cost technical assistance program designed to help small businesses improve their marketing strategies and financial management skills. This program can be valuable for growers who may not know where to begin or who lack organized financial records. Through one-on-one guidance and practical tools, growers can gain the knowledge and support needed to improve their recordkeeping, assess their financial health, and position themselves for better financing opportunities. A summary of the benefits of 3CORE’s technical assistance programs is provided here.

In addition to these resources, walnut growers can use a user-friendly spreadsheet from UC Cooperative Extension to track their costs and returns (Access the spreadsheet here). Once downloaded, you can input your own cost information in the yellow-shaded sections of the third sheet titled ‘costs per acre – user input.’ The results will automatically populate in the ‘cost per acre – output’ sheet. This resource can be helpful for growers looking to better organize their expenses and financial records, as well as assess the profitability of their operations.

Managing farm finances is an ongoing learning process. However, by understanding key financial statements, tracking important metrics, and leveraging available resources, growers can strengthen their financial health and improve their borrowing potential.

Leave a Reply